Managing money can be stressful and money problems are common. Over 69 per cent of people are concerned about money, so if it is causing you a headache, you are not alone.

It is a lot easier to spend money than save it, but with some simple tips and tricks, you can reduce your spending and keep your hard-earned money in your pocket so you’re prepared for those ‘rainy day’ situations.

YOUR CHALLENGE: Review where you spend more money than you need to and try out our easy ideas, each week, on how to spend less.

How to make it happen

WEEK 1: Try these 5 tricks to save money on your home expenses this winter

First things first, it is a good idea to check in with how much you spend on your household expenses, if you aren’t currently across it. With so many of our payments coming out automatically, these days, it can be easy to lose track of what money is going where. Awareness is the first stage of change so, if you need to, use this as an opportunity to check your bank and credit card statements and review your home expenses.

- Using a fan is a good way to circulate heat

- Blocking the gaps around your curtains with towels or blankets can help stop heat escaping

- Electric blankets or throws are a cheap way to keep warm

- Choosing the right electricity supplier for you can save you significant amounts of money. Head to Powerswitch for price comparisons

- Keeping the filter on your heat pump clean can help it run more efficiently.

These tips are thanks to Consumer NZ.

Over the next three weeks we will release our top tips for saving money based on the following themes:

WEEK 2: Review the little things that add up

How much money are you spending on travel each day? And how about the added extras such as food and drinks? What about any apps and online memberships you are currently paying for, are you still actually using them? This week is a good time to look at how much you spend on your everyday activities and what you buy when you are out and about.

- Change the way you commute to work If you currently drive to work, are there any other options that could work for you? Now could be a great time to do a cost analysis of driving and parking versus public transport. Or look at biking or eBiking to work for the added benefit of exercise and time outside, too. If you eBike to work, rather than drive, you could save well over $1000 a year ( based on a 100km commute each week) which means, over time, the eBike will pay for itself, and you will be healthier.

- Pack your lunch If you often find yourself buying food on the go, it can really add up. Coffee and snacks can add up too. Set yourself a realistic goal, such as taking your lunch Monday to Thursday and buying it out on Friday, or buying a coffee three days a week rather than two a day. If you need inspiration for healthy lunches to take to work, there are plenty of ideas here.

- Review apps and membership sites Check your bank statements or the app store on your phone to remind yourself what you are paying for. If you aren’t using the service they are offering anymore, make a note to cancel them before they automatically renew.

- Is your mobile phone plan right for you? What about your internet? Your insurance? Use this week as an opportunity to check in with what you pay for your plans. And talk to your bank to make sure you are using the best accounts, credit cards and loans systems for your current situation.

- Carry water Buying drinks out adds up, be it bottled drinks or coffees. Add up how much you spend on drinks over the week and set a goal to reduce it.

WEEK 3: Save money on your food shop

Plan your meals Planning meals ‘on the fly‘, while in-store, can be a big mistake. Not planning ahead of time means you may come home from shopping with bags of goodies but nothing to make into a meal.

And winging it when you get home after work can make you more likely to get frustrated and call or head out for a takeaway.

Meal planning really is the best way to eat healthily and prevent waste – and it doesn’t need to be at all complicated. Try our meal planner here.

Make a list and stick to it Without a list, you’re more likely to make impulse purchases in the supermarket, especially if you walk up and down random aisles.

Plan your trip through the store according to your list – and don’t go shopping when you’re hungry, as there’s a greater chance you’ll grab extras you don’t really want or need.

Perhaps consider ordering online, then either pick up the groceries in-store or have them delivered. This can help prevent impulse purchases.

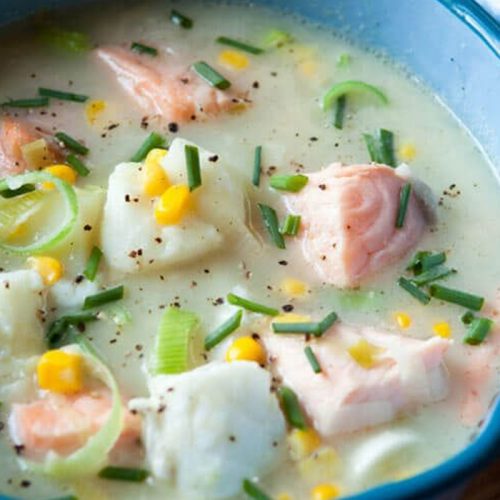

Reconsider protein Meat, chicken and fish are often the most expensive items in a weekly shop. Diversify your protein by including much cheaper options, such as legumes (lentils, beans and chickpeas), which are packed with protein and will keep you feeling full.

You don’t have to become vegetarian: just halving your meat and bulking out your meal with legumes is a smart move. Start by adding a can of lentils to your Bolognese.

And keep a range of canned legumes in your pantry, ready to add to salads or soups and to bulk out stews.

Tinned fish is cheaper than fresh and eggs are another inexpensive option to help boost protein in your meals. Check out our budget-friendly recipes here.

Watch out for wellness fads You may hear about how you need coconut oil, matcha and the latest trendy, expensive supplement. But many food trends may be only loosely backed by science, if at all.

No single food is ever going to lengthen your life or make you healthy – it’s really the quality of your overall intake that matters.

And none of these foods are a match for the nutrition you’ll get by eating plenty of veg and fruit. If bought in season, fresh produce will be at its cheapest and most delicious. Fruit and veg provide the best nutritional bang for buck – and there are so many different, tasty ways to prepare them.

Reduce waste

- Keep your potatoes and onions separate – storing them together causes them to sprout

- Apples and pears will last a lot longer if you keep them in the fridge too. Check out more storage tips here

- Freeze foods that are close to their use-by date and that you won’t use in time

- Stew up fruit that’s going soft, freeze bananas that are turning brown (but peel them first)

- Make soups or stews from limp vegetables

- If you have a humidity setting on your crisper, setting it to low will make fruit that is prone to rotting easily, such as apples, pears and stonefruit, last a good bit longer. Check out more ideas on reducing waste and saving money here.

WEEK 4: Having fun on a budget

You don’t always have to spend to have fun. There are loads of cost-effective or free ways to have a good time. These are some of our top suggestions:

- Get involved in community sports Check out the offerings from your local parks and rec department. They may have activities you can directly participate in, or there may be opportunities where you can coach, referee, or simply be part of the audience, cheering people on.

- Play board games Rediscover your inner child and pull a board game out of your closet to play with your family or friends.

- Check out your local nature walks Connecting with nature is shown to be good for your mental wellbeing. Or, alternatively, organise a self-guided walking tour. Go to Google Maps and look for interesting places that are near you, then figure out a walk that takes you to those spots. Parks, businesses, memorials – make it a walking tour!

- Visit a free museum or a zoo (or find out when you might be able to get in for free). Are there any museums or zoos or art galleries in your area? Look online and see if they have free passes available or if they offer free admittance on certain days.

- Call or video call a friend or family member If you have some relatives or friends that you haven’t seen in a long time, give them a call them. It’s a great chance to see how children have grown, what your friends are up to and reconnect.

- Check out your local community calendar Visit your community’s website and see what free events are happening this weekend.

Need more help with your finances?

There are some great resources out there to support you with your finances. Here are some of the places we have found that might be helpful:

New Zealand:

- It can be very stressful if you’ve lost your job, are facing a drop in income, or are behind in your rent. There is help and support available here

- ‘Check what you can get’ helps you find out what benefits and payments may be available to you

- Money Talks gives free and confidential budgeting advice. They have phone help, live chat, email and text and can link you with a local service. Call the free financial advice Money Talks helpline on 0800 345 123

- You can find your local budgeting advice service here

- A great website is govt.nz, created specifically to help with getting back into work or training after a COVID-19 job loss

- moneyworries.co.nz and depression.org.nz/moneyworries have helpful tips and advice about looking after your wellbeing at times of financial stress

- Budget advice is available at fincap.org.nz.

Australia:

- Moneysmart is a good point of contact if you are looking for support with your finances.

www.healthyfood.com